Staden Model

Why we choose to lose money when we onboard new clients.

Proving trust and integrity.

The most important aspect of choose a financial adviser is to choose one that you trust puts your best interests first. This isn't an easy task as you have to worry whether the adviser will put their interests before yours. This is a problem we wanted to solve at Staden Financial Management.

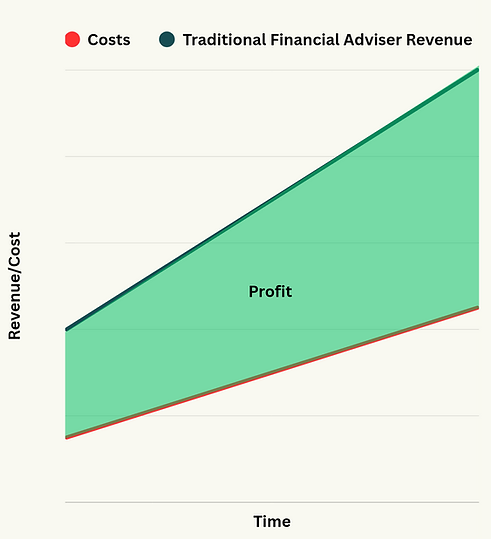

Unlike traditional remuneration models for financial advice companies we don't charge initial fees or accept 3rd party commissions. We charge monthly fees based off of assets under management.

This means that we don't cover our costs of onboarding clients immediately.

If we give bad advice and a client leaves too early in our adviser - client relationship, we will lose money from that client.

Why this protects you

-

We cannot afford to give you bad advice. If we recommend a strategy that doesn't work for you, you will leave. If you leave early, We don't just lose future profit; we lose the money we spent setting you up as a client.

-

We will not onboard you if you don't need us. If we don't believe we can provide value to you for the long term, there’s no point in taking you on as a client.

Trust shouldn't be something you have to hope for; it should be baked into the contract.

If we don't deliver value, we don't just lose a client. We lose money. And that is exactly how it should be.

The Staden Model aligns adviser and client interests by introducing the possibility poor financial advice can cost the adviser.

.png)